The global steel wear liner market stands at a critical juncture in 2026. Valued at approximately USD 350.6 million in 2023 and projected to expand to USD 590.56 million by 2035, this market reflects the broader industrial imperative to reduce downtime, extend equipment lifecycles, and optimize operational costs across mining, cement, construction, and metallurgical sectors. More significantly, the broader wear parts ecosystem—encompassing wear liners, castings, and specialized coatings—is projected to reach USD 1.2 trillion by 2035, underscoring the critical economic importance of wear solutions in modern industrial infrastructure.

The market's trajectory is shaped by five converging forces: accelerating demand from emerging markets, technological breakthroughs in advanced ceramic composites, adoption of AI-powered predictive maintenance systems, China's 2026 export licensing reforms, and the industry-wide shift from cost minimization to total cost of ownership (TCO) optimization. This comprehensive analysis examines market dynamics, technological innovations, regional opportunities, and strategic imperatives for stakeholders across the supply chain.

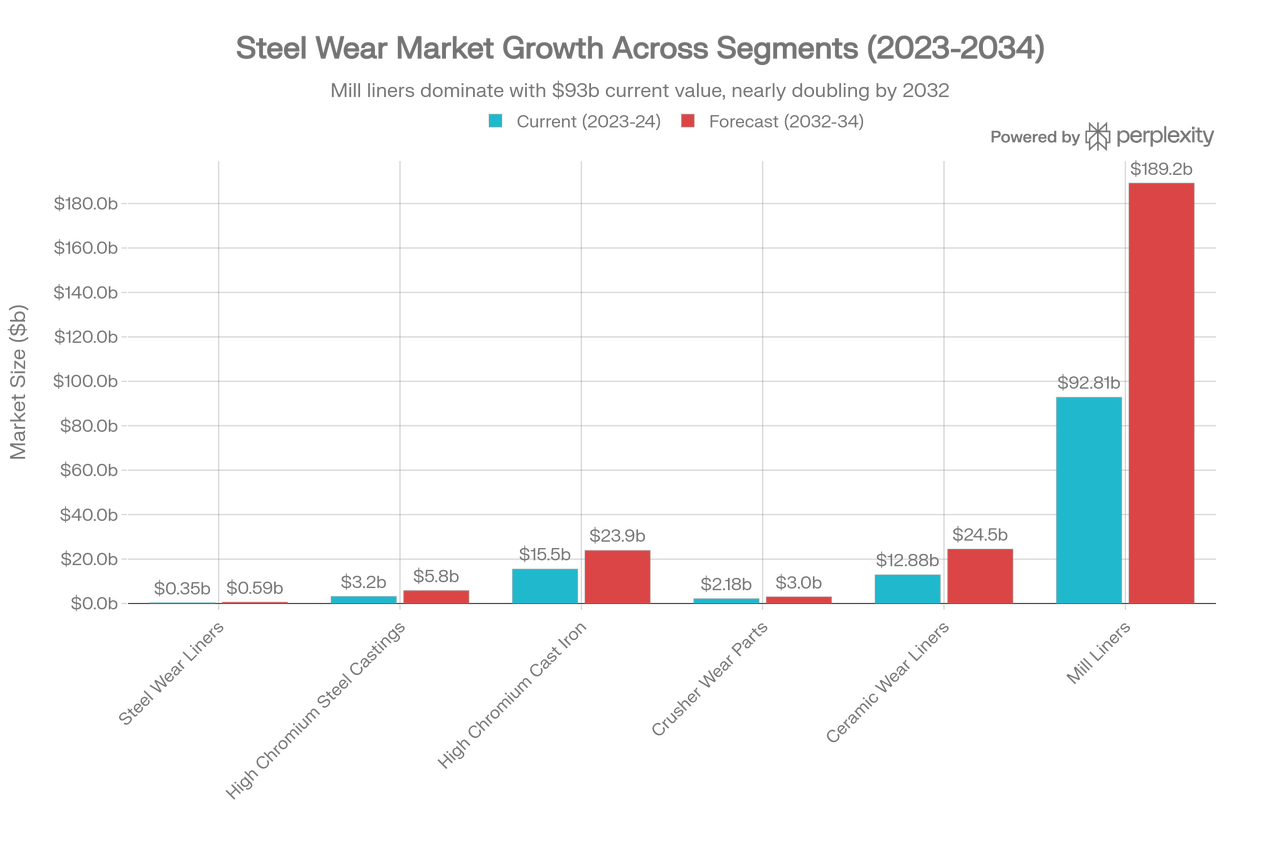

Global Wear Liner and Related Markets: Current Valuations and Forecast Projections

Steel wear liners specifically comprise USD 350.6 million of the 2023 global market, growing at a measured 4.2% compound annual growth rate through 2032. However, alternative forecasts suggest the segment could reach USD 2.5 billion by 2034 at a 2.83% CAGR, indicating significant variance in analyst assumptions regarding market definition and end-user penetration. This ambiguity reflects the market's fragmentation across multiple product categories—from traditional steel to advanced ceramics—where classification boundaries remain somewhat permeable.

By contrast, advanced material categories demonstrate substantially higher growth momentum. The ceramic wear liner market, valued at USD 12.88 billion in 2024, is expanding at 8.76% CAGR through 2032, reflecting accelerating adoption driven by superior performance characteristics and declining cost premiums. The mill liner segment—encompassing liners for grinding mills in mining and cement operations—represents the largest addressable category at USD 92.81 billion in 2023, projected to reach USD 189.2 billion by 2032 (7.3% CAGR), indicating the tremendous scale of cement and mining equipment operations globally.

High chromium steel castings, a foundational material for wear-resistant applications, constitute USD 3.2 billion in 2024 and are forecast to reach USD 5.8 billion by 2034 at a 6.2% CAGR, driven by innovations in heat treatment and alloy composition that extend service life by 30-40%. These castings form the core material basis for premium wear liner solutions, particularly in high-impact mining applications.

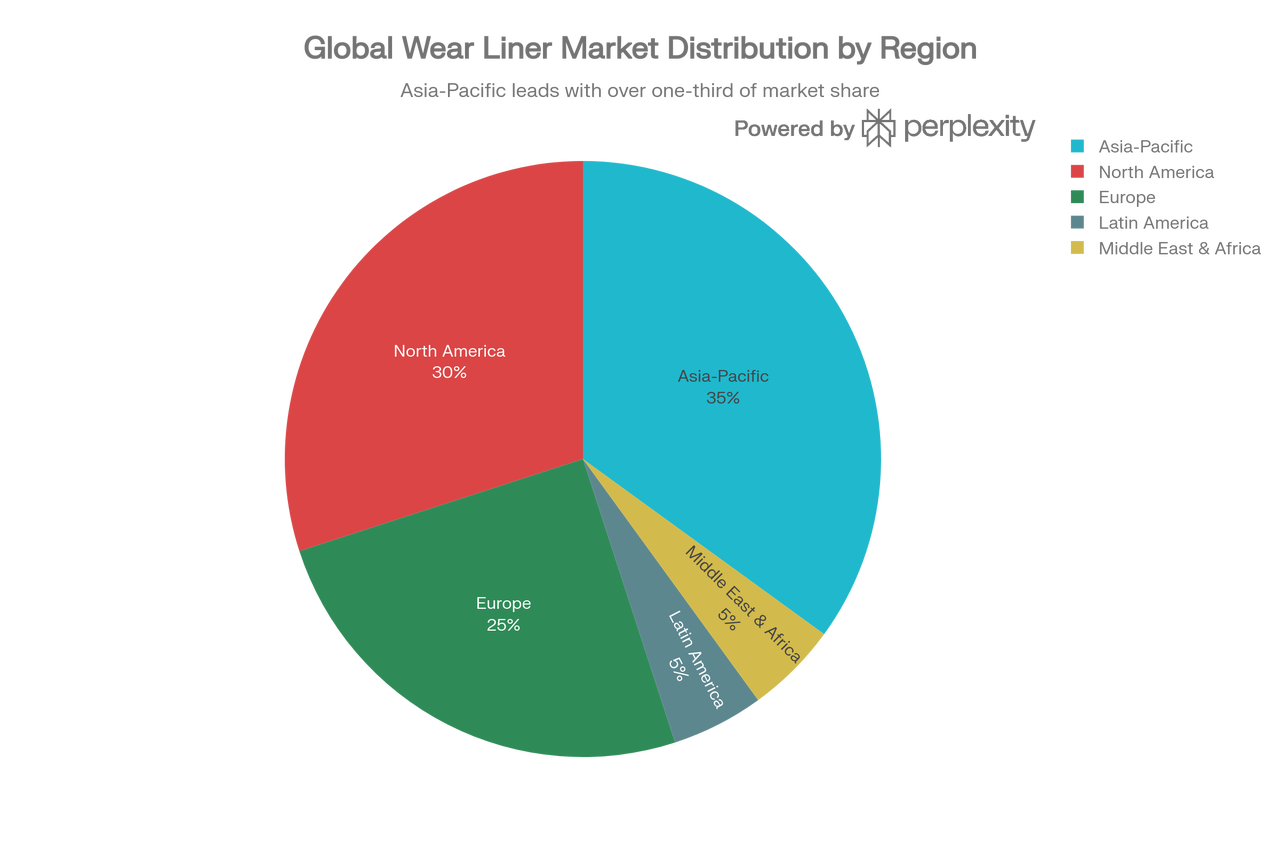

The global wear liner market exhibits pronounced regional concentration, with Asia-Pacific commanding 35% of market share, propelled by rapid industrialization, urbanization, and mining expansion in China, India, and Southeast Asia. This region's dominance reflects both manufacturing capacity and end-user demand. China's iron ore imports reached a record 1.26 billion tons in 2025, with imports projected to grow an additional 36-38 million tons in 2026, signaling continued robust mining activity and downstream demand for grinding and crushing equipment components.

North America accounts for 30% market share, sustained by infrastructure modernization, mining investments, and the presence of advanced manufacturing clusters. U.S. mining equipment spending is expected to grow from USD 100 billion in 2023 to USD 150 billion by 2030, creating sustained demand for replacement and upgrade components.

Latin America and Middle East & Africa collectively represent 10% of the market, with Brazil emerging as a growth driver through iron ore production (400 million tons in 2023) and infrastructure development.

The wear liner market encompasses a hierarchy of material solutions, each optimized for distinct operational environments and cost profiles:

High Chromium Cast Iron and Steel remain the industry standard for high-impact applications. Recent breakthroughs in gradient heat treatment technology—employing multi-stage variable temperature processes—have increased impact toughness by more than 50% compared to traditional products while maintaining hardness. China's wear-resistant castings industry is achieving service life improvements of 30-40% through advanced heat treatment innovation, with export volumes growing 24% year-over-year in 2025. These materials are particularly suited for crushing and grinding applications where impact resistance is critical.

Ceramic Composite Liners represent the fastest-growing technology category. Alumina ceramics with hardness ratings exceeding HRA85 are combined with high-quality rubber backing to create composite systems that extend service life by 10-20 times compared to traditional manganese steel liners. The dual-layer composite approach—ceramic tiles bonded to rubber with steel backing plates—provides simultaneous impact absorption and abrasion resistance, critical for conveyor transfer stations and mill discharge chutes handling ore and aggregates. The concrete pump industry has achieved over 60,000 m³ service life with dual-layer composite piping systems, validating this technology's performance under extreme wear and corrosion conditions.

Polyurethane and UHMW Plastic Liners serve cost-sensitive applications where wear resistance requirements are moderate. While offering low friction coefficients (reducing material hang-up and carry-back) and installation simplicity, these materials lack the hardness and durability of advanced ceramics for high-abrasion environments. However, magnetic fastening systems for polyurethane liners have reduced installation time and labor costs, enabling faster equipment maintenance and reduced production downtime.

Composite Steel Liners (cladded chromium carbide on mild steel backing) deliver 200-600% efficiency improvements in wear resistance compared to traditional weld-cladded composite wear plates, with exceptionally low coefficients of friction reducing binding and material accumulation.

Haitian Heavy Industry, a leading Chinese wear-resistant casting manufacturer with 80,000 tons annual capacity and 236 employees across 35,000 m² of production facilities, exemplifies the industry's technological trajectory. The company has invested in 3D sand mold printing equipment that reduces new product development cycles from months to two weeks, enabling rapid customization for specific customer applications. This capability positions advanced manufacturers to respond swiftly to market demands and deliver engineered solutions rather than commodity products.

The company has also developed high-temperature cast ceramic composite materials, representing a convergence of advanced ceramics technology (incorporating graphene and nano-oxides for enhanced toughness) with traditional casting processes. These materials extend operational temperature ranges and enable applications previously restricted to metals, reducing weight while improving durability in extreme environments.

The mining sector remains the primary demand driver for wear liner innovation. Global mining equipment spending is forecast to grow from USD 100 billion in 2023 to USD 150 billion by 2030, representing a 50% expansion. This growth is driven by increased mineral exploration, higher commodity prices, and energy transition investments (copper for EV batteries, lithium for energy storage, cobalt for electronics).

Each major mining operation runs crushers, mills, and conveyor systems continuously, with equipment availability critically affecting throughput and profitability. A single day of unplanned downtime in a major iron ore or copper mine can cost USD 500,000 to USD 2 million in lost production. Accordingly, mining operators prioritize wear liner solutions that maximize mean time between failures (MTBF) and reduce maintenance intervals.

Field trials demonstrate that engineered wear-resistant castings outperform standard alternatives by 2-3 times in service life, with some high-performance ceramic composite systems achieving 3-5 times the wear life of conventional solutions. These performance gains directly translate to reduced capital expenditure on replacement equipment, lower labor costs for maintenance interventions, and increased production capacity utilization.

Global construction output is forecast to grow by 85% from 2023 to 2030, reaching USD 15 trillion, primarily driven by urbanization in Asia-Pacific and infrastructure projects in developing economies. Concrete production—a primary application for mill liners and wear-resistant castings—requires massive grinding capacity. Cement plants operate ball mills and rod mills continuously, subjecting liners to high-impact and abrasive wear. A major cement plant may grind 5,000-10,000 tons of raw materials daily, generating sustained demand for high-performance liner replacement cycles.

Construction equipment manufacturers (Caterpillar, Komatsu, SANY) specify premium wear liners in their crushing and grinding equipment, with equipment uptime requirements driving the adoption of advanced material solutions that reduce service intervals from monthly or quarterly to semi-annual or annual cycles.

A critical market inflection point is emerging in how operators and procurement teams evaluate wear liner investments. Traditional procurement focused on unit price minimization—selecting the lowest-cost solution meeting minimum specifications. This approach is rapidly shifting toward TCO analysis, which factors in acquisition cost, installation labor, maintenance frequency, downtime risk, and disposal/recycling value.

TCO analysis reveals that advanced ceramic composite liners, despite 30-50% higher upfront costs, deliver superior economics over a 2-3 year operating cycle. A concrete pump operation replacing elbow pipes every 6 months with traditional steel liners versus every 18-24 months with ceramic composite dual-layer systems realizes significant labor and inventory cost reductions. Similarly, mining operations running predictive maintenance systems that schedule liner replacements based on condition monitoring achieve 30% downtime reduction compared to time-based replacement schedules.

A critical regulatory development is reshaping global supply chains: China implemented a new export licensing system effective January 1, 2026, requiring wear-resistant casting manufacturers to obtain export permits through rigorous quality and environmental audits. This regulation eliminates "cheap, low-end" components from international supply chains and creates a bifurcation between licensed, high-performance suppliers and domestic-only manufacturers.

For global procurement teams, this regulatory environment creates both risk and opportunity. Risk emerges from potential supply constraints and lead-time extensions for Chinese-sourced components. Opportunity emerges for manufacturers with export licensing credentials and proven track records of reliability—including companies like Haitian Heavy Industry, which possesses ISO 9001, ISO 14001, and ISO 45001 certifications plus recognition as a "National Intelligent Manufacturing Excellence Scene" facility.

This licensing reform accelerates the move toward higher-cost, higher-performance suppliers worldwide, tightening the margin for lowest-cost competitors and strengthening the market position of technologically advanced manufacturers.

The integration of artificial intelligence and predictive maintenance into industrial operations is fundamentally reshaping wear parts procurement and inventory management. Rather than replacing wear liners on fixed time intervals, advanced operators now use real-time sensor data, machine vision, and machine learning algorithms to forecast equipment failures and schedule maintenance proactively.

This approach enables "just-in-time" spare parts ordering, where predictive models forecast when specific components will need replacement and trigger procurement 1-2 weeks before failure risk becomes acute. The benefits include reduced inventory holding costs, faster response times to critical breakdowns, and improved equipment uptime. For a large mining operation managing thousands of wear components across hundreds of machines, this transition to predictive systems can reduce inventory carrying costs by 20-30% while improving equipment availability.

Enterprise Resource Planning (ERP) systems are becoming the backbone for integrating predictive maintenance with procurement, inventory, and financial operations. Leading mining and cement companies are investing in fully synchronized supply chains from parts manufacturing to delivery, creating end-to-end visibility that minimizes downtime and optimizes cash flow.

Haitian Heavy Industry's adoption of information management systems (ERP, MES, OA, and CRM) positions the company to support customers' predictive maintenance initiatives, enabling real-time collaboration on inventory planning and maintenance scheduling.

3D sand mold printing technology has emerged as a game-changing innovation in wear liner manufacturing. By digitizing part geometries and automating mold production, manufacturers have reduced product development cycles from 4-6 months to 2 weeks. This acceleration enables:

Rapid prototyping and customization: Engineers can design optimized wear liner geometries for specific customer applications (ore type, impact patterns, flow dynamics) and validate designs through 3D printed molds before committing to full-scale production.

Complex geometry capability: 3D printing enables designs that traditional sand casting cannot economically produce—gradient thickness profiles, integrated retention features, and boundary-optimized shapes that reduce material waste and extend service life.

Supply chain flexibility: Manufacturers can respond to unexpected demand surges or customer specification changes without retooling foundry equipment, reducing lead times and improving customer satisfaction.

The long-term implication is that wear liner manufacturing is shifting from commodity-style batch production toward engineered, application-specific solutions. This shift advantages manufacturers with advanced digital capabilities and automation investment, further consolidating market share toward technology leaders.

Research in advanced ceramics is advancing material performance frontiers:

Gradient ceramics: Multi-layer ceramic systems with varying hardness profiles optimize the balance between hardness (resisting abrasion) and toughness (absorbing impact).

Nanoceramics: Zirconia nanoceramics achieve toughness 5 times that of traditional ceramics (15 MPa·m^1/2 versus 3 MPa·m^1/2) while maintaining hardness, dramatically extending service life.

Composite matrix innovations: Incorporation of graphene and nano-oxides into ceramic matrices improves thermal conductivity and impact resistance, enabling use in higher-temperature applications and more corrosive environments.

Bioceramics and sustainability: 3D-printed bioceramics enable patient-specific manufacturing approaches that, when adapted to industrial applications, allow for customized wear liner designs optimized for specific equipment geometries and duty cycles.

These material science advances will increasingly enable wear liner performance enhancements of 2-3 times in the next 5-10 years, further accelerating the TCO advantage of advanced solutions over commodity alternatives.

The wear liner market exhibits a bifurcated competitive structure: large, diversified steel and materials companies versus specialized, application-focused wear liner manufacturers.

Large global players including SSAB, JFE Steel, ThyssenKrupp, Dillinger, and ArcelorMittal dominate wear-resistant steel production, leveraging integrated supply chains, R&D resources, and customer relationships spanning automotive, machinery, and construction sectors. SSAB generates over USD 10 billion in annual revenue and has positioned itself as a leader in high-strength steel solutions through investments in sustainability and production innovation.

Specialist wear liner manufacturers such as Trelleborg, FLS Smith, Mellott Company, and TEMA ISENMANN focus specifically on application engineering for mining, cement, and bulk material handling. These companies differentiate through specialized design expertise, field service networks, and performance guarantees backed by extensive field data.

Advanced manufacturing capabilities: Intelligent production systems (MES, ERP integration) enabling quality consistency and responsive customization

Technical expertise: Participation in national casting standards formulation and collaboration with major domestic universities

Scale economies: 80,000 tons annual capacity with 7-day average delivery cycles enables rapid response to global demand fluctuations

Export credentials: ISO 9001, ISO 14001, ISO 45001 certifications plus recognition as a high-tech enterprise position the company for 2026 export licensing compliance

International competition is intensifying as Chinese manufacturers achieve quality parity with traditional Western producers while maintaining 20-30% cost advantages. This dynamic is accelerating technological competition in advanced ceramics, predictive maintenance integration, and supply chain digitalization.

Advanced ceramic composite liners (combining alumina ceramics at HRA85+ hardness with resilient rubber backing) have become the preferred solution for primary crushing, extending liner life from 2-4 weeks to 8-12 weeks—a 2-3 times improvement translating to 30-50% reduction in downtime and labor costs.

Mill liners in grinding mills experience different wear regimes: high-speed impact and abrasion as ore tumbles within rotating mills. Mill liner selection balances impact absorption (favoring rubber components) against abrasion resistance (favoring steel and ceramics). The broader mill liner market—estimated at USD 92.81 billion in 2023—reflects the sheer scale of grinding capacity globally.

Cement manufacturing demands grinding mill liners capable of processing limestone, clay, and clinker at hardness levels of 40-60 HV. Raw material grinding rates can reach 200-300 tons per hour per mill, generating continuous abrasive wear on liners. Cement plants typically operate multiple mills continuously, and downtime directly reduces production and increases per-unit production costs.

Composite liners (ceramic + rubber) have achieved 30-50% extended service life compared to traditional steel liners, with installations in major cement plants across Asia-Pacific and Europe demonstrating consistent performance improvements.

This application segment is growing with infrastructure expansion, particularly in emerging markets investing in transportation and urban development infrastructure.

| Market Factor | 2026 Status | 2030 Outlook | Implication |

| Market Size (Global) | ~USD 350M (steel liners) | USD 590M+ (6% CAGR) | Sustained steady-state growth in traditional steel segment, explosive growth in ceramics |

| Material Mix | 70% steel, 20% ceramic, 10% plastic | 50% steel, 40% ceramic, 10% plastic | Ceramic composites becoming mainstream, displacing commodity steel solutions |

| Technology Level | 3D printing in early adoption (5% of manufacturers) | Widespread adoption (60%+ of manufacturers) | Rapid customization and engineered solutions becoming standard competitive requirement |

| Supply Chain Model | Commodity-based, price-driven sourcing | Performance-based, TCO-driven partnerships | Shift toward long-term supplier relationships with SLAs and uptime guarantees |

| Geographic Concentration | China 40%, Rest of World 60% | China 35%, APAC 50%, Other 15% | Increasing localization and regional manufacturing clusters; export licensing pressure on Chinese suppliers |

| Customer Integration | 10% with predictive maintenance systems | 50%+ with predictive systems | Digital integration becoming table-stakes; suppliers becoming data partners not just commodity sellers |

| Sustainability Focus | Emerging compliance requirement | Core competitive differentiator | Carbon footprint, recyclability, and extended lifecycle become primary purchase criteria |

Ceramic displacement of steel: Within 3-5 years, ceramic composite liners will represent >40% of volume in high-value mining and cement applications as TCO advantages compound and manufacturing cost premiums compress.

Regionalization of supply chains: 2026 export licensing and tariff pressures will accelerate investment in regional manufacturing capacity, reducing Asia-Pacific concentration and building out North American and European production clusters.

Services transition: Wear liner suppliers increasingly offer performance-based service models (uptime guarantees, predictive maintenance integration, fleet management) rather than transactional sales, creating recurring revenue streams and deepening customer relationships.

Digital transformation of procurement: Integration with customer ERP, MES, and IoT systems will become baseline expectations, requiring suppliers to invest in software/data capabilities alongside material science R&D.

Emerging market industrialization: Continued expansion of mining, cement, and infrastructure projects in Asia-Pacific, Latin America, and Africa generating baseline demand growth of 5-7% annually.

Technology adoption cycles: Advanced ceramics, 3D printing, and AI integration moving from early-adopter to mainstream phases, accelerating performance improvements and cost reduction.

Regulatory tailwinds: Carbon border adjustment mechanisms, export licensing, and tariff structures creating advantages for high-performance, high-quality suppliers while commoditizing low-cost competitors.

Sustainability imperatives: Net-zero commitments in mining, cement, and construction driving demand for materials that extend equipment lifecycle and reduce embedded carbon per unit of production.

The competitive dynamic will increasingly favor manufacturers who integrate material science innovation, digital capabilities, supply chain resilience, and customer-centric service models. Companies like Haitian Heavy Industry, positioned at the nexus of advanced manufacturing (80,000 tons capacity, 3D printing, ISO certifications) and emerging market demand (China-based with growing global export presence), exemplify the winning archetype for the next decade.

The steel wear liner market is undergoing a fundamental transformation from a commodity-driven business focused on cost minimization toward a technology-driven, performance-oriented market emphasizing total cost of ownership and integrated operational solutions. Market size growth—from USD 350.6 million in 2023 to USD 590+ million by 2035—represents steady baseline expansion driven by mining and infrastructure development. However, the market's strategic significance extends far beyond these headline numbers.

Migration from commodity steel toward advanced ceramic composites capable of extending service life 3-5 times

Integration of wear parts procurement with predictive maintenance systems and digital supply chains

Consolidation of competitive advantage toward manufacturers combining material science innovation, digital capabilities, and supply chain resilience

Geographic rebalancing of production toward high-capability, export-licensed suppliers in response to 2026 regulatory changes

For operators, procurement teams, and equipment manufacturers, the 2026-2032 period represents an opportunity to fundamentally transform wear management from reactive cost-cutting toward proactive performance optimization. The winners will be those who invest in supplier partnerships emphasizing technology, transparency, and shared outcomes rather than transactional price competition.