The global asphalt manufacturing industry reached $36.7 billion in 2025, with the United States representing the largest market segment. However, size alone does not guarantee service quality. Procurement managers evaluating asphalt plant parts vendors must balance competing priorities: accessing parts quickly during emergencies, securing competitive pricing for planned purchases, assessing supplier technical expertise, and establishing reliable long-term partnerships.

Unlike commodity procurement, sourcing asphalt plant parts demands a sophisticated understanding of supplier differentiation, vendor capabilities, and inventory strategies. This guide examines how industry decision-makers evaluate and compare suppliers to optimize equipment uptime, control costs, and mitigate operational risk.

Buyers seeking asphalt plant parts fall into three primary purchasing scenarios, each with distinct urgency levels and decision criteria:

Planned Maintenance Sourcing: Facility managers executing scheduled maintenance—such as seasonal filter replacements, conveyor belt upgrades, or burner overhauls—operate with extended timelines measured in weeks or months. These buyers emphasize pricing competitiveness, bulk discounts, and technical consultation to ensure they select the correct components for their specific plant configuration.

Vendor Relationship Building: Procurement teams conducting formal vendor evaluations to establish preferred supplier agreements seek comprehensive capabilities across multiple dimensions. These strategic sourcing initiatives involve RFPs, site audits, financial vetting, and scalability assessments to lock in favorable terms and reduce supply chain fragmentation.

Understanding which scenario drives your organization's purchasing behavior is foundational to evaluating suppliers effectively. A vendor excelling at emergency response may not offer the lowest pricing for bulk orders, while a supplier providing superior technical consultation may lack the inventory depth for urgent needs.

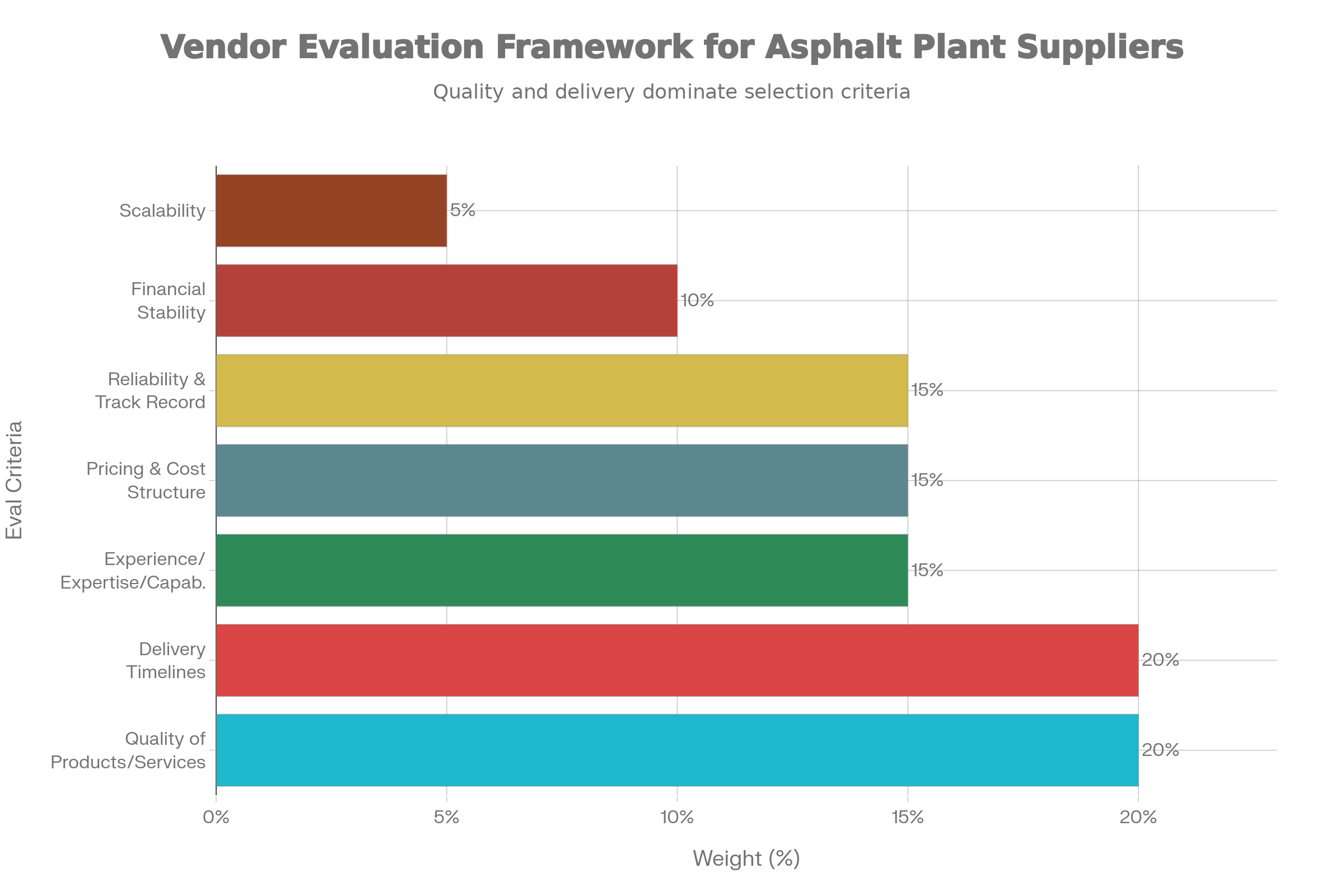

Procurement best practices in the construction and equipment industries converge on a consistent evaluation framework. Research across construction supply chains, vendor selection protocols, and equipment procurement standards identifies seven primary criteria that predict supplier performance and buyer satisfaction.

Quality of Products and Services (20% Weight): Quality represents the heaviest weighting in vendor selection because product defects directly threaten operational integrity. For asphalt plants, this means verifying that supplier components meet AASHTO and ASTM standards, carry proper certifications (such as ISO 9001:2000), and include quality assurance documentation. Evaluating suppliers requires requesting product specifications, test data, and references from past customers who can attest to durability and reliability under operational stress.

When assessing quality, procurement teams should request copies of supplier quality control systems, including testing methodologies, compliance audits, and corrective action processes. Suppliers offering third-party inspection options—such as through independent testing laboratories—demonstrate confidence in their quality systems and reduce buyer risk.

Delivery Timelines (20% Weight): Tied with quality, delivery performance directly impacts plant uptime. Procurement managers must understand supplier lead times across three dimensions: standard delivery for planned purchases, expedited availability for urgent needs, and geographic coverage for multi-site operations.

Lead times vary significantly by part type. Standard electrical components and fasteners may arrive within 24–48 hours from Louisville-based hubs (such as those operated by major distributors), while specialized burner components or drum liners may require 3–8 weeks from manufacturers or international suppliers. Progressive suppliers publish lead time classifications for their inventory, enabling procurement teams to optimize safety stock levels and reorder points.

Experience, Expertise, and Capabilities (15% Weight): Technical knowledge separates commodity suppliers from specialized vendors. Suppliers with 30+ years in asphalt plant service possess accumulated expertise across multiple equipment manufacturers (Astec, Gencor, ADM), plant configurations (stationary, portable, continuous-flow), and component generations (legacy equipment through current models).

This expertise translates into practical value: recommending the correct bearing size for a specific mixer model, identifying incompatible seal materials that cause premature failure, or advising on retrofit options for obsolete equipment. Procurement teams should evaluate whether supplier sales engineers, field service technicians, and support staff hold relevant certifications and possess hands-on experience troubleshooting asphalt plants.

Pricing and Cost Structure (15% Weight): While quality and delivery receive higher weightings, pricing directly impacts operating margins. Effective supplier evaluation compares not only unit prices but total landed costs, including shipping, handling, and expedited fees. Suppliers offering bulk discounts, tiered pricing for repeat purchases, and transparent pricing structures reduce long-term procurement costs.

Sophisticated procurement teams employ total cost of ownership (TCO) analysis, which accounts for acquisition price, inventory carrying costs, obsolescence risk, and opportunity cost of capital. A slightly higher unit price from a supplier offering 2-week delivery may prove more cost-effective than a discount supplier with 6-week lead times, because the faster delivery reduces safety stock investment.

Reliability and Track Record (15% Weight): Supplier reputation reflects consistency in fulfilling commitments across quality, delivery, and service dimensions. Online reviews, industry testimonials, case studies, and customer references provide evidence of actual performance rather than marketing promises.

Construction industry suppliers often participate in certification programs and hold industry awards (such as supplier of the year recognition from major equipment OEMs). Financial stability assessments—examining profitability, liquidity, and creditworthiness—predict a supplier's ability to withstand market downturns without disrupting service.

Financial Stability (10% Weight): A financially unstable supplier risks operational disruption if they face cash flow constraints, bankruptcy, or acquisition by a competitor. Evaluating financial health requires reviewing recent financial statements, debt ratios, and customer concentration risk. Suppliers generating 30% referral orders and 15% repeat purchases (indicating high customer satisfaction) demonstrate financial sustainability.

Scalability (5% Weight): As asphalt contractors grow operations or undertake larger projects, supplier capacity must accommodate increased demand. Evaluating scalability means assessing manufacturing capacity, supply chain resilience, and staffing levels. Suppliers operating 200,000+ square meter facilities with 1,000+ skilled personnel demonstrate capacity to handle volume growth without quality degradation.

The asphalt plant parts market includes both independent distributors (like Hotmix Parts) and integrated OEM suppliers (like Astec Industries). Each operating model offers distinct advantages:

Hotmix Parts & Service: Operating from Louisville, Kentucky—home to the UPS Worldport—Hotmix Parts has positioned itself as the emergency response leader in asphalt plant support. With 70,000+ items in stock and 24/7 customer support, the company targets procurement teams facing equipment failures that cannot tolerate delay. Their service model combines rapid parts delivery with field engineering consultation, enabling plant operators to diagnose problems and execute repairs without manufacturer involvement.

The competitive advantage: Same-day or next-morning delivery for most in-stock items leverages Louisville's logistics hub status. Over 30 years of industry experience translates into diagnostic expertise across all major plant brands. Their "Anything for an Asphalt Plant" positioning reflects inventory breadth covering used components, refurbished parts, and hard-to-find items for legacy equipment.

Motion Engineering Inc.: With 40+ years specializing in industrial parts for asphalt plants, Motion Engineering differentiates on technical expertise and hard-to-find sourcing. Rather than competing on inventory volume, Motion Engineering focuses on solving complex sourcing challenges—locating obsolete components, custom manufacturing replacement parts, and providing engineering consultation on equipment integration.

The competitive advantage: Motion Engineering serves facility managers operating legacy equipment where standard suppliers cannot source parts. Their technical team provides design services for retrofit projects, enabling contractors to upgrade aging plants without wholesale replacement. This specialization creates defensible competitive positioning in the retrofit and upgrade market segment.

Stansteel: Positioned as "America's #1 manufacturer" of asphalt plant equipment, Stansteel combines parts distribution with custom manufacturing and integration services. Operating as both a supplier and systems integrator, Stansteel serves contractors planning major plant upgrades or custom installations.

The competitive advantage: Stansteel's manufacturing capability enables rapid prototyping and custom components that standard distributors cannot produce. Integration services—coordinating components from multiple suppliers into coherent system designs—appeal to contractors building new facilities or undertaking comprehensive modernizations.

AIMIX Group: Operating a 200,000 square meter manufacturing facility with 1,000+ skilled staff, AIMIX Group represents the integrated global supplier model. Active in 150+ countries with 500+ successful projects, AIMIX serves international contractors and large-scale producers requiring equipment plus comprehensive parts support.

The competitive advantage: AIMIX combines equipment manufacturing with localized after-sales support networks, reducing dependence on international logistics. A 200,000 sq m manufacturing footprint enables vertical integration—producing components in-house rather than relying on external suppliers, which reduces lead times and improves quality control consistency.

Astec Industries: As the OEM (original equipment manufacturer) for asphalt plants sold under the Astec brand since 1972, Astec controls the complete product lifecycle from design through spare parts supply. The company emphasizes innovative burner technology (including the Whisper Jet LE burner) and IoT-integrated plant controls.

The competitive advantage: As the OEM, Astec possesses definitive technical documentation, design specifications, and proprietary knowledge about equipment operation. Contractors operating Astec equipment gain the most authoritative technical support and access to components specifically engineered for their plant configuration.

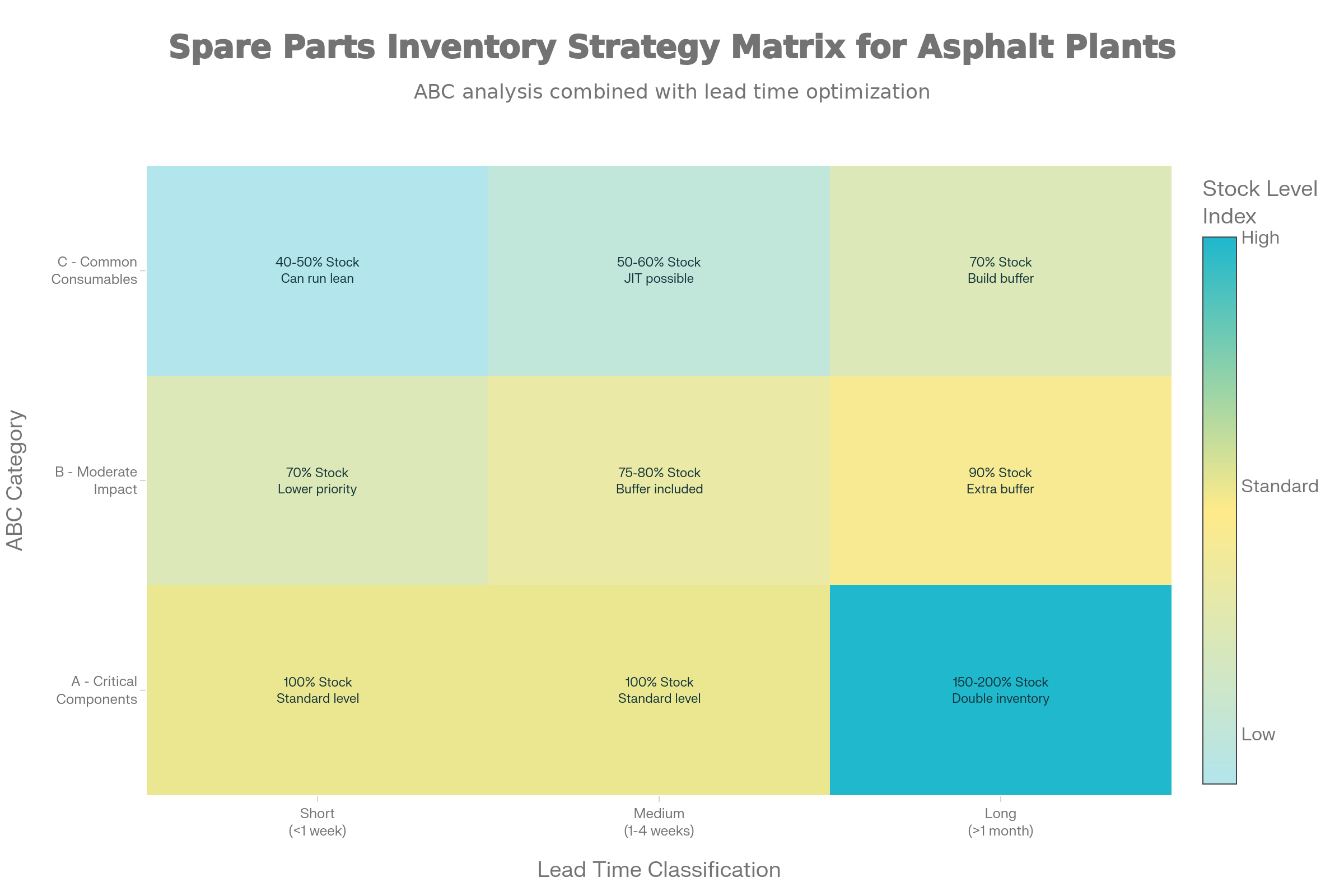

The cost of unplanned downtime for asphalt plants exceeds $5,000–$10,000 per hour when accounting for labor, lost production capacity, and project delay penalties. Forward-thinking facility managers employ ABC inventory analysis to optimize spare parts stocking strategies, ensuring critical components remain available while controlling carrying costs.

Category A – Critical Components (100% Availability Target): Items whose failure causes immediate plant shutdown require permanent inventory readiness. Dryer drum liners, electric motors, gearboxes, and baghouse filters represent Category A components. The downtime cost of searching for these parts exceeds the inventory carrying cost, justifying 100% stock availability.

For Category A items with long supplier lead times (exceeding 4 weeks), procurement best practice involves maintaining multiple units in stock. For shorter lead times, single-unit backup stock proves adequate. Facility managers should establish automatic reorder points tied to consumption patterns, ensuring replacement stock arrives as on-hand inventory depletes.

Category B – Moderate Impact Components (70–80% Availability Target): Items causing significant but not catastrophic downtime warrant staged inventory strategies. Conveyor belts, bearings, hydraulic valves, and thermocouples exemplify Category B parts. These components have longer useful lives than consumables, but their failure impairs plant efficiency or forces partial shutdowns.

Procurement teams should classify Category B items by supplier lead time, then adjust stock targets upward for long lead time items. A bearing available within 2 weeks requires less backup inventory than a specialized conveyor belt with 6-week delivery.

Category C – Common Consumables (50–60% Availability Target): Fasteners, seals, gaskets, small belts, and lubricants represent high-consumption, low-individual-cost items. While individually inexpensive, stocking excessive quantities ties up working capital. Just-in-time or bulk purchase strategies work for Category C items because their short lead times (typically <1 week) allow rapid replenishment.

Procurement teams should calculate optimal purchase quantities balancing bulk discounts against inventory carrying costs. Automated reorder systems that trigger purchase orders when stock reaches defined thresholds reduce manual effort and prevent stockouts.

Short lead time (< 1 week): Lower safety stock sufficient

Medium lead time (1–4 weeks): Moderate buffer inventory advisable

Long lead time (> 4 weeks): Substantial safety stock or backup units essential

Combining ABC categorization with lead time classification enables quantitative inventory optimization. A critical component (Category A) with 8-week lead time from a single supplier might warrant 2–3 backup units, while a moderate component (Category B) with 2-week availability might require just 1 backup unit.

Procurement professionals follow structured evaluation processes that reduce bias and ensure systematic comparison across candidates:

Before evaluating specific suppliers, procurement teams must define detailed requirements. This includes specifying required parts, quantities, quality standards (ASTM/AASHTO compliance), delivery timelines, and geographic location preferences. Published specifications and quality standards eliminate vague evaluation criteria.

Initial screening eliminates vendors unable to meet core requirements. Examples include geographic location restrictions (some contractors prefer domestic suppliers), certification requirements (ISO 9001 compliance), or specialized capabilities (OEM service for specific equipment brands).

Procurement teams distribute RFIs requesting detailed information about supplier capabilities, inventory levels, delivery options, pricing structures, and service models. RFIs typically request copies of quality certifications, customer references, financial statements (or creditworthiness verification), and technical documentation.

Quality RFI responses distinguish serious vendors from casual competitors. Suppliers providing detailed inventory lists, published lead times, and transparent pricing excel in this phase. Those offering vague responses or requesting confidentiality about standard offerings signal potential challenges in future dealings.

Using the weighted evaluation framework described earlier, procurement teams score candidate vendors across each criterion. Quantitative metrics (delivery time, inventory quantity, pricing) enable direct comparison, while qualitative factors (technical expertise, service quality) require scoring against defined standards.

Developing a scoring matrix creates transparency, reduces bias, and provides documentation supporting final selection decisions. Weighted scoring naturally surfaces trade-offs: for instance, a vendor scoring higher on quality and delivery may score lower on pricing, but their total weighted score reflects whether the quality premium justifies higher cost.

For large or long-term supplier relationships, on-site facility audits provide direct evidence of operational capability. Procurement teams should assess manufacturing quality, inventory organization, technology systems, and workforce expertise. Customer reference calls from facilities similar to your own operation provide insights into real-world performance.

During reference checks, ask specific questions about delivery reliability, technical support quality, problem resolution speed, and pricing fairness. References from customers operating plants comparable to yours provide more relevant insights than generic testimonials.

Winning vendor proposals advance to negotiation phase. Procurement teams negotiate terms spanning pricing, volume discounts, payment terms, delivery guarantees, and service level agreements (SLAs). Effective contracts specify:

Part specifications and quality standards

Delivery timelines and expedited options

Pricing and discount structure

Inventory availability guarantees

Technical support and field service availability

Warranty terms and quality guarantees

Quarterly business reviews to assess performance

Phase 6: Performance Monitoring and Periodic Re-evaluation

Supplier relationships require ongoing performance management. Procurement teams should track metrics including on-time delivery percentage, quality issue resolution speed, pricing competitiveness, and customer service responsiveness. Quarterly business reviews with key suppliers identify improvement opportunities and prevent service degradation.

Periodic competitive re-evaluation—every 2–3 years—ensures your selected vendors remain optimal choices. Market dynamics, supplier capability changes, and evolving business requirements justify occasional reassessment.

Sustainability and Environmental Compliance: Increasingly, contractors prioritize suppliers offering environmentally compliant components. Upgraded baghouse filters reduce emissions, automated lubrication systems minimize waste, and burner technology focusing on fuel efficiency appeal to contractors facing stricter environmental regulations. Suppliers investing in sustainable manufacturing processes position themselves favorably with environmentally conscious buyers.

Digital Integration and IoT: Modern asphalt plants integrate IoT sensors and cloud-based monitoring systems. Suppliers offering parts compatible with predictive maintenance systems—where sensors track component condition and alert operators before failure—command premium valuations. Integration with plant management software enables automatic spare parts reordering when predictive analytics forecast imminent failures.

Modular and Retrofit Solutions: Rather than complete plant replacement, contractors increasingly pursue targeted upgrades. Suppliers offering modular components and retrofit-compatible parts capture growing demand from contractors with aging but still-productive equipment. Stansteel's integration services and Motion Engineering's retrofit expertise exemplify this trend.

Supply Chain Consolidation: Mergers and acquisitions consolidate regional suppliers into larger platforms. This consolidation brings benefits (improved logistics, broader inventory) and risks (potential service gaps if consolidation disrupts localized expertise). Procurement teams should monitor consolidation activity among preferred suppliers to anticipate potential changes.

Asphalt plant equipment costs range from $500,000 (smaller portable units) to $4 million (large stationary operations). Parts and maintenance represent 10–15% of total ownership costs across equipment lifecycles. Sophisticated cost analysis requires evaluating total cost of ownership rather than unit pricing alone.

Unit pricing comparison example: Supplier A quotes $15,000 for a replacement dryer drum liner with 6-week delivery. Supplier B quotes $14,200 for the same component with 2-week delivery. Supplier A appears cheaper until factoring in working capital costs and downtime risk. At a 10% cost of capital, the extra 4-week inventory carrying period costs $600 in financing expense. Additionally, the shorter delivery timeline from Supplier B reduces required backup inventory by one unit, saving an additional $14,200 in tied-up capital.

Quality impact on TCO: Lower-priced components that fail prematurely or require more frequent replacement increase lifetime costs. Premium suppliers justify higher unit prices through superior durability, resulting in lower replacement frequency and total spending across equipment lifecycles.

Bulk discount analysis: Volume discounts incentivize larger purchases but increase inventory carrying costs. Optimal purchase quantity balances discount benefits against financing costs and obsolescence risk. Suppliers offering tiered pricing (10%+ discount for 3-unit orders, 15% for 5-unit orders) enable customized volume strategies matching organizational consumption patterns.

Supplier financial distress: Evaluate supplier financial stability before committing to long-term relationships. Request financial statements or creditworthiness verification. High customer concentration (where one customer represents >20% of revenue) indicates vulnerability to customer loss. Suppliers with diversified customer bases demonstrate resilience.

Supply chain disruption: Single-source dependency creates vulnerability. For critical components, identify alternative suppliers or maintain expanded safety stock from your primary vendor. Global suppliers (like AIMIX with presence in 150+ countries) demonstrate supply chain resilience compared to single-location operators.

Technology obsolescence: Equipment manufacturers periodically discontinue components or redesign them. Suppliers offering both new and used components (like Hotmix Parts) mitigate obsolescence risk by sourcing legacy parts for retiring equipment. Motion Engineering's custom manufacturing capability addresses obsolescence by engineering replacement components when originals become unavailable.

Quality and warranty issues: Establish clear quality guarantees and warranty terms in supplier contracts. Specify remedies for defects, including replacement timelines and cost allocation. Suppliers willing to accept liability for quality issues demonstrate confidence in their products.

Selecting the right asphalt plant parts suppliers represents one of the highest-impact procurement decisions facility managers and procurement teams face. Unlike commodity purchases, this decision directly influences equipment uptime, operational reliability, and long-term costs.

The vendor evaluation framework outlined in this guide—weighing quality (20%), delivery (20%), expertise (15%), pricing (15%), reliability (15%), financial stability (10%), and scalability (5%)—provides a quantitative methodology for comparing candidates. Leading suppliers including Hotmix Parts (emergency response), Motion Engineering (technical expertise), Stansteel (integration services), AIMIX (global operations), and Astec Industries (OEM solutions) each excel in specific dimensions, requiring procurement teams to align selection criteria with organizational priorities.

Implementing sophisticated spare parts inventory management—using ABC analysis and lead time classifications—minimizes downtime risk while controlling carrying costs. Following a structured six-phase vendor selection process (requirements definition, RFI, scoring, audits, negotiation, monitoring) reduces bias, improves decision quality, and creates documentation supporting procurement decisions.

Your asphalt plant's performance depends critically on the suppliers you choose. Invest time in thorough evaluation, and your organization will realize returns across reliability, cost, and operational efficiency for years to come.