Selecting the right casting jaw crusher jaw plate supplier represents one of the most consequential procurement decisions for mining operations, quarrying facilities, and recycling plants. Beyond simple cost considerations, this decision directly impacts equipment reliability, operational downtime, material processing efficiency, and long-term total cost of ownership.

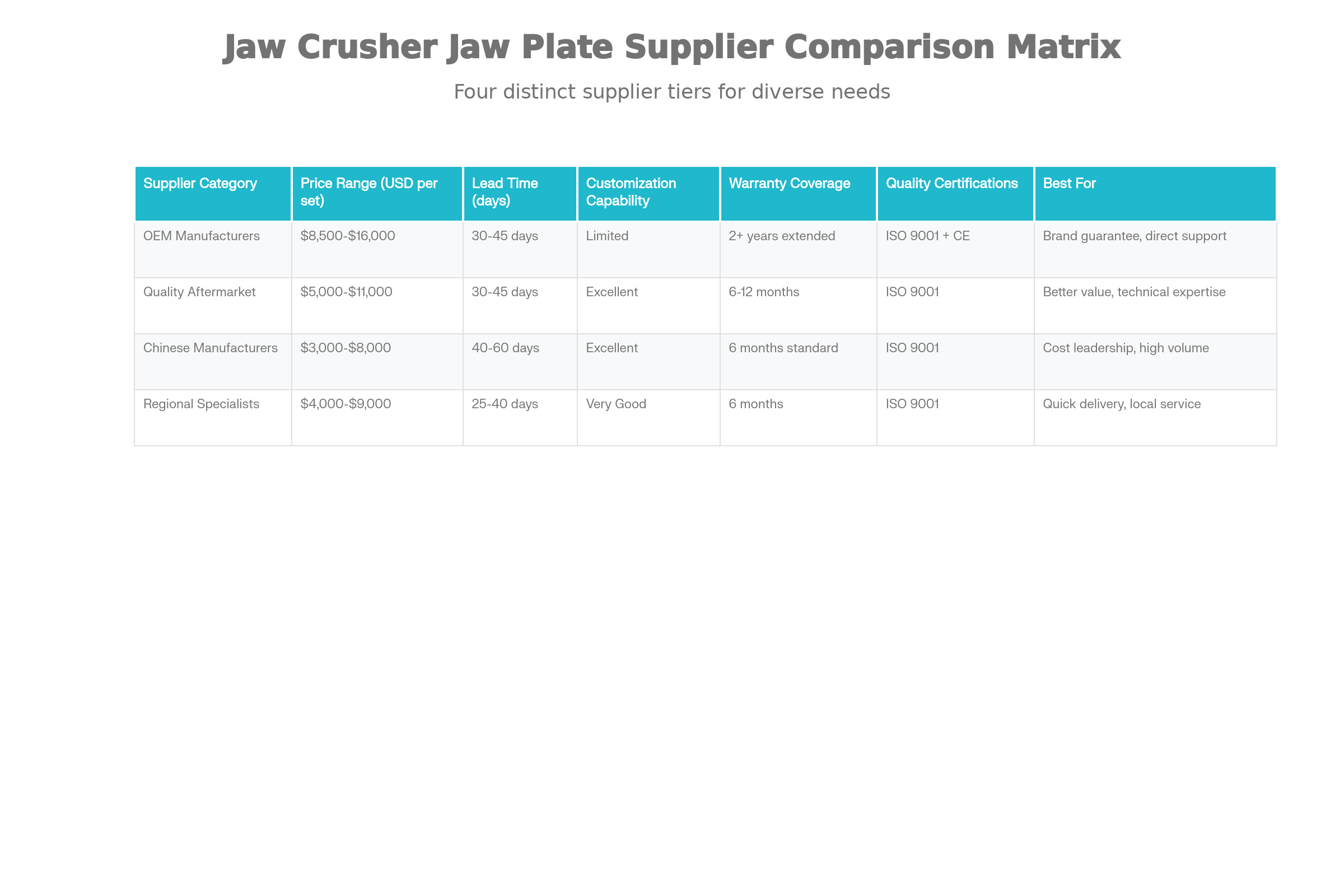

Procurement professionals and plant managers face a complex vendor landscape comprising original equipment manufacturers (OEMs) commanding premium pricing with guaranteed compatibility, quality aftermarket suppliers balancing value and expertise, Chinese manufacturers dominating the cost-competitive segment, and regional specialists offering quick turnaround and local support. Each category presents distinct trade-offs across price, lead time, customization capabilities, quality assurance, warranty coverage, and technical support.

The stakes justify rigorous evaluation. A single jaw plate failure during peak production triggers cascade effects: immediate production stoppage, emergency replacement expediting at premium costs, potential equipment damage during changeover, labor inefficiencies, and lost revenue. Conversely, over-investing in premium OEM products when cost-effective alternatives meet specifications squanders capital and reduces competitive positioning.

This comprehensive guide helps procurement teams, plant engineers, and operations managers navigate supplier comparison frameworks, understand quality standards and certifications, assess risk factors, and develop structured decision matrices aligned with organizational priorities.

ISO 9001:2015 Quality Management Systems represents the baseline certification demonstrating a supplier's commitment to standardized manufacturing processes, documented quality procedures, statistical process control, and continuous improvement methodologies. Suppliers holding active ISO 9001 certification have undergone rigorous third-party audits verifying compliance with internationally recognized quality standards.

Formal documented quality procedures and work instructions

Raw material sourcing protocols and supplier qualification programs

In-process quality checks at defined manufacturing stages

Final product inspection and testing procedures

Statistical process control tracking key metrics (hardness, chemistry, dimensions)

Customer complaint management and continuous improvement systems

Management review and internal audit procedures

CE Certification (European Conformity) represents mandatory compliance for manufacturers serving the European Economic Area (EEA), indicating adherence to European Product Directive requirements and stringent safety/performance standards. CE-certified jaw plates demonstrate that manufacturers have conducted comprehensive product safety testing, completed conformity assessments, maintained technical documentation, and committed to post-market surveillance.

Raw material selection directly determines jaw plate performance characteristics and operational reliability. High-manganese steel (Mn13Cr2, Mn18Cr2, Mn22Cr2) remains the industry standard due to exceptional work-hardening properties that develop hardness through operational impact rather than traditional heat treatment.

Hardness testing (Brinell HRC measurement) typically ranges 48-51 HRC for standard jaw plates, with premium grades achieving higher specifications. Suppliers should provide batch testing certifications documenting hardness verification at multiple points across each production lot, ensuring consistency across all components.

Chemistry verification through spectroscopic analysis confirms material composition accuracy. Third-party laboratory testing validates that supplied material matches specification requirements (manganese percentage, chromium content, carbon levels) within acceptable tolerances. Metallographic analysis—examining grain structure under microscopic magnification—identifies potential casting defects, segregation issues, or contamination that could compromise performance.

Production capacity directly impacts supplier reliability during surge demands, emergency situations, or significant project requirements. Minimum annual production capacity of 80,000+ tons indicates substantial manufacturing infrastructure, multiple production lines, and inventory buffers enabling rapid order fulfillment.

Lead time represents critical evaluation parameter often overlooked until emergency situations force accelerated sourcing. Standard lead times range 25-60 days depending on supplier category, inventory status, and customization complexity. Regional specialists typically offer 25-40 day delivery, while Chinese manufacturers requiring longer international shipping require 40-60 days. OEM and quality aftermarket suppliers typically maintain 30-45 day timeframes.

Emergency delivery capabilities demonstrate supplier flexibility and responsiveness. Forward-thinking suppliers maintain buffer inventory or rapid-response protocols enabling 10-15 day expedited delivery at modest premiums, critical for operations facing unplanned equipment failures during high-production periods.

Equipment standardization varies globally. Older equipment installations, imported machinery from international suppliers, or region-specific configurations often require non-standard jaw plate designs where conventional catalog products fail to achieve proper seating or acceptable gap specifications.

Leading suppliers maintain engineering capabilities enabling custom design and manufacturing for non-standard crusher models.

This capability addresses critical customer pain points:

Retrofitting equipment from discontinued production lines

Adapting plates for equipment modified with alternative crushing configurations

Engineering solutions for specialized applications (extreme abrasion, high-impact conditions)

Modifying tooth patterns to optimize material flow in unique crushing scenarios

Customization complexity varies—simple dimensional modifications adding 10-15 days to lead time, while engineering custom designs from specification requiring 30-45 days including design verification and prototype testing. Suppliers explicitly stating customization capabilities and providing reference cases of previous custom projects indicate engineering maturity.

Warranty coverage reflects manufacturer confidence in product quality and represents direct risk transfer to the supplier. OEM manufacturers typically provide 2+ year extended warranties with comprehensive coverage, reflecting their confidence in brand-name products and commitment to customer satisfaction. Quality aftermarket suppliers offer 6-12 month warranties, balancing coverage with competitive pricing. Chinese manufacturers standard 6-month warranties represent common industry baseline.

Technical consultation for plate selection and installation

Rapid response protocols for customer issues

Replacement parts availability and emergency stockpiling

Installation guidance and troubleshooting documentation

Performance optimization recommendations based on field experience

Preventive maintenance schedules and wear monitoring guidance

Suppliers maintaining regional service centers or distribution networks provide faster emergency response compared to single-location manufacturers requiring international shipping for warranty claims.

Price evaluation requires structured analysis comparing cost per unit with expected service life and quality metrics, rather than simple lowest-price selection. Premium OEM jaw plates at $8,500-$16,000 per set lasting 6-8 months may deliver lower cost-per-month than bargain alternatives at $3,000-$5,000 requiring replacement every 3 months.

Three-year total cost projections incorporating replacement frequency, labor costs, production downtime impact, and warranty coverage provide comprehensive cost analysis superseding single-purchase price comparison. A higher-priced plate extending service life by 25% while reducing annual replacement frequency from 3-4 to 2-3 replacements often delivers 15-25% superior total economic value.

Volume-based pricing discounts from quality suppliers frequently reduce per-unit costs by 10-25% for committed annual volume commitments (typically 6+ sets), enabling cost alignment with budget parameters while maintaining quality standards.

OEM manufacturers including Metso Outotec, Sandvik AB, FL Smidth, and ThyssenKrupp represent equipment manufacturers producing crushers and supplying genuine replacement components. These suppliers hold fundamental advantages: intimate knowledge of equipment specifications ensuring perfect compatibility, engineering support from designer perspective, integrated warranty coverage through OEM maintenance programs, and brand-name reputation reflecting decades of operating experience.

Key Strengths: Brand guarantee, direct manufacturer support, guaranteed compatibility, long-term customer relationships

Quality aftermarket manufacturers including WearKraft, Columbia Steel, and AGICO Cement specialize in replacement wear parts for multiple equipment brands. These suppliers achieve superior value positioning through specialized focus, optimized manufacturing, and engineering expertise developed across diverse application scenarios.

Key Strengths: Better value, technical expertise, customization capabilities, responsive service

Quality aftermarket suppliers differentiate through engineering excellence. Columbia Steel's Xtralloy 24% manganese steel, for example, incorporates specialized heat treatment and stress-relief processes extending wear life 15-25% compared to standard compositions. These suppliers maintain technical teams capable of analyzing customer crushing applications, recommending optimal material grades and tooth patterns, and engineering custom solutions for specialized equipment.

Chinese manufacturers including Qiming Casting, EB Castworld, and MGS Casting dominate the cost-competitive segment, leveraging lower labor costs, established manufacturing infrastructure, and high-volume production. These suppliers serve price-sensitive customers prioritizing cost minimization, high-volume requirements, and secondary/non-critical equipment applications.

Key Strengths: Cost leadership, high volume capacity, customization flexibility, rapid production scaling

Chinese manufacturers achieve extreme cost competitiveness through labor advantages, streamlined operations, and willingness to operate on thin margins compensated through volume. Production capacity often exceeds 50,000+ tons annually, enabling fulfillment of large volume orders or emergency surge requirements. Customization capabilities remain excellent due to flexible manufacturing processes and minimal tooling constraints.

Quality variation represents the primary risk. While reputable Chinese suppliers (20+ years operating history, industry certifications, established customer base) deliver acceptable quality, smaller manufacturers lack rigorous quality control, complete certifications, or performance guarantees. Procurement teams prioritizing Chinese suppliers should verify ISO 9001 certification, request performance references, and conduct third-party quality audits before long-term commitments.

Regional specialists including JXSC and Amardeep Engimech serve geographic markets offering quick turnaround, local technical support, and supply chain flexibility. These suppliers typically operate 1-3 production lines with 8,000-15,000 annual capacity, emphasizing service quality and rapid delivery over volume scale.

Key Strengths: Quick delivery, local service, technical support, regional presence

Regional specialists provide ideal solutions for operations prioritizing rapid response and local technical engagement. JXSC's established distribution network across Asia-Pacific enables faster emergency delivery compared to distant manufacturers. Local technical teams familiar with regional equipment configurations provide superior consultation for non-standard applications.

ISO 9001:2015 certification demonstrates systematic quality management implementation across the supplier's entire organization.

The standard requires documented procedures for critical processes including:

Supplier qualification programs ensuring raw material sources meet specifications

Incoming material inspection and testing protocols

Material traceability systems enabling batch identification

Storage and handling procedures preventing contamination

Manufacturing Control:

Work instructions defining production steps and quality checkpoints

In-process inspection at critical stages (casting, heat treatment, finishing)

Equipment maintenance and calibration procedures ensuring consistency

Statistical process control charts tracking key metrics over time

Quality Verification:

Final inspection and testing of every product batch

Hardness testing (Brinell HRC measurement) at multiple sample points

Chemistry verification through spectroscopic analysis

Dimensional inspection confirming tolerance compliance

Continuous Improvement:

Customer complaint management and root cause analysis

Corrective action procedures addressing identified non-conformances

Management review assessing effectiveness and identifying improvements

Internal audits verifying procedure compliance

Suppliers maintaining current ISO 9001 certification have demonstrated compliance through successful third-party audits occurring every 12-36 months. Certification requires continuous conformance, regular management review, and ongoing training programs. Procurement teams can request ISO 9001 certificates directly and verify current status through issuing certification bodies.

CE certification (European Conformity) represents mandatory requirement for products marketed within the European Economic Area. The certification confirms that jaw plates meet European Product Directive safety and performance requirements. The CE marking process requires:

Product design specifications and drawings

Material composition and property data

Manufacturing process descriptions

Quality assurance procedures

Risk assessment and mitigation measures

Conformity Assessment:

Testing by accredited laboratories validating safety claims

Documentation demonstrating compliance with relevant European standards

Declaration of Conformity signed by manufacturer or authorized representative

CE marking affixed to products and accompanying documentation

CE-certified jaw plate suppliers have typically engaged third-party testing laboratories, conducted comprehensive product testing, and maintained detailed technical files demonstrating conformity. These suppliers maintain superior documentation and quality control rigor compared to suppliers without CE certification.

Hardness testing using Brinell or Rockwell scales measures jaw plate resistance to deformation under mechanical stress, directly correlating with crushing performance and wear resistance. Standard jaw plates typically target 48-51 HRC (Brinell equivalent), with premium grades achieving 52-55 HRC.

Quality suppliers provide batch testing documentation showing hardness measurements at minimum 3-5 sample points across each production lot. This sampling approach identifies variation, segregation, or heat treatment inconsistencies affecting product quality. Extreme hardness variation (>5 HRC) within a single batch indicates quality control deficiency.

Impact testing (Charpy or Izod methods) measures toughness and work-hardening capability—the ability of manganese steel to develop hardness progressively during operational impact rather than brittle failure. Quality suppliers conducting impact testing demonstrate commitment to material properties affecting operational reliability.

Raw material composition directly determines jaw plate performance. Specified manganese percentages (typically 11-18% depending on grade), chromium content (0.5-3.0%), carbon levels (0.8-1.3%), and trace element management ensure consistent work-hardening and impact resistance properties.

Suppliers should conduct spectroscopic analysis (emission spectroscopy or X-ray fluorescence) on representative samples from each production lot, documenting elemental composition against specification requirements. Chemistry certificates from accredited laboratories provide objective verification.

Non-compliant material substitution represents a deliberate fraud indicator. Suppliers experiencing cost pressures may source cheaper materials with slightly different compositions, degrading performance while maintaining acceptable hardness readings. Third-party chemistry verification from independent laboratories protects against this risk.

Warranty coverage reflects manufacturer confidence and represents critical risk transfer mechanism. Beyond basic replacement guarantees, comprehensive after-sales support structures differentiate premium suppliers.

| Supplier Category | Warranty Duration | Coverage Scope | Response Time | Replacement Cost | Technical Support |

| OEM Manufacturers | 2+ years extended | Comprehensive (parts + labor) | 24-48 hours | Full replacement | Direct engineer access |

| Quality Aftermarket | 6-12 months | Parts only or comprehensive options | 2-5 business days | Replacement or repair credit | Phone/email support |

| Chinese Manufacturers | 6 months standard | Parts only (labor excluded) | 5-10 business days | Replacement negotiated | Limited (email-based) |

| Regional Specialists | 6 months | Parts only | 1-3 business days | Replacement available | Local technical team |

OEM manufacturers provide superior warranty structures reflecting brand reputation and customer retention priorities. Metso Outotec and Sandvik offer 2-3 year extended warranties with comprehensive coverage including both parts and installation labor. These warranties indicate manufacturer confidence and long-term customer relationship commitment.

Quality aftermarket suppliers typically offer 6-12 month warranties with flexible coverage options. Six-month basic coverage addresses infant mortality and immediate defects, while extended 12-month options provide additional protection for higher-risk applications. Some suppliers offer warranty credit toward replacement costs, creating alternative customer value.

Chinese manufacturers standard 6-month warranties reflect industry baseline and cost-competitive positioning. Premium Chinese suppliers may offer extended coverage options, though enforcement and claim processing often present challenges requiring well-documented communication and photographic evidence.

After-sales support quality often exceeds warranty formal terms. Premium suppliers maintain responsive customer service, provide technical consultation for installation optimization, and offer emergency replacement protocols. These support structures reduce customer downtime and build long-term partnership value.

Equipment diversity across global markets requires suppliers capable of engineering custom jaw plate designs. Non-standard equipment scenarios include:

Older Equipment Retrofitting: Equipment manufactured 15-25 years ago often lacks current standard specifications, requiring custom designs enabling proper seating and gap maintenance.

International Equipment: Machinery imported from non-standard suppliers or region-specific configurations may require dimensional adaptation or tooth pattern modification.

Specialized Applications: Extreme abrasion environments (recycled concrete, contaminated ore) or high-impact conditions may require custom material specifications or tooth design optimization.

Equipment Modifications: Customers retrofitting existing equipment with alternative crushing configurations may require non-standard plate geometries.

Technical drawings and CAD modeling capabilities

Material testing and custom specification development

Prototype manufacturing and validation testing

Installation documentation and dimensional verification

Customization timeframes typically range:

Simple dimensional modifications: 10-15 day extension to standard lead times

Custom designs from specifications: 25-35 days including design verification

Prototype development and field testing: 40-60 day extended timeframes for complex applications

Suppliers highlighting custom design case studies and referencing previous non-standard projects demonstrate engineering maturity and customer commitment.

Production capacity directly influences supplier reliability during surge demands and emergency situations. Minimum 80,000+ ton annual capacity indicates substantial manufacturing infrastructure capable of handling large volume orders or rapid production scaling.

| Supplier Category | Standard Lead Time | Emergency Delivery | Minimum Order Quantity | Production Scalability |

| OEM Manufacturers | 30-45 days | 10-15 days (expedited fee) | Single sets | Medium (inventory-dependent) |

| Quality Aftermarket | 30-45 days | 15-20 days | Single sets | Medium-High |

| Chinese Manufacturers | 40-60 days | 20-30 days | 2-4 sets (volume discounts) | High (flexible capacity) |

| Regional Specialists | 25-40 days | 5-10 days | Single sets | Medium |

Regional specialists achieve fastest standard lead times through local inventory positioning and shorter supply chain complexity. Emergency delivery capabilities (5-10 days) make regional specialists ideal for operations experiencing unplanned equipment failures during peak production.

Chinese manufacturers' longer international shipping requirements translate to 40-60 day standard lead times, though emergency delivery expediting and air freight options reduce timeframes to 20-30 days at significant premium costs. Minimum order quantities and volume discounts (typically 10-25% for 3+ sets, 20-40% for 6+ sets) encourage forward purchasing and inventory strategies.

OEM manufacturers maintain inventory buffers enabling 30-45 day standard delivery, with expedited delivery available at modest premiums ($1,500-$3,000 additional charges). These suppliers' customer retention focus creates responsiveness motivation exceeding typical aftermarket service levels.

Material Substitution Risk: Suppliers under cost pressure may source cheaper materials with similar hardness but inadequate impact resistance or work-hardening properties. Mitigation requires third-party chemistry verification and periodic impact testing.

Manufacturing Consistency Risk: Inadequate statistical process control creates batch-to-batch variation in hardness, composition, or dimensions. Mitigation requires requesting control charts and conducting onsite quality audits.

Documentation Authenticity Risk: Falsified certifications or testing documentation represent fraud indicators. Mitigation requires direct verification with issuing organizations and third-party lab confirmation.

Lead Time Delays: International shipping, customs clearance, or production delays create schedule risks. Mitigation requires advance ordering, buffer stock strategies, or regional supplier relationships enabling rapid emergency delivery.

Capacity Constraints: Single-source suppliers lack redundancy; production disruptions create critical supply interruptions. Mitigation requires dual-sourcing strategies or multi-supplier portfolio approaches.

Currency and Trade Risks: International suppliers present foreign exchange volatility and trade policy exposure. Mitigation requires favorable payment terms, currency hedging strategies, or regional sourcing prioritization.

Supplier Financial Stability: Suppliers experiencing financial distress may reduce quality investment or cease operations without notice. Mitigation requires credit checks, financial statement review, and relationship diversity.

Organizational Changes: Ownership transitions, management changes, or production relocations often degrade quality and service. Mitigation requires monitoring supplier news, maintaining communication with decision-makers, and formal partnership agreements.

Relationship Deterioration: Long-term supplier relationships without formal agreements risk quality degradation or service withdrawal. Mitigation requires regular performance reviews, documented expectations, and periodic quality audits.

Effective supplier selection requires systematic evaluation across multiple criteria. The following framework enables objective comparison:

Cost (weighted 20-40% depending on budget constraints)

Quality (weighted 15-35% depending on risk tolerance)

Delivery Speed (weighted 10-30% depending on inventory capacity)

Technical Support (weighted 10-25% depending on internal expertise)

Customization (weighted 5-20% depending on equipment diversity)

STEP 2: Supplier Qualification Screening

ISO 9001 certification verification

Manufacturing facility adequacy (third-party assessment)

Financial stability (credit check, reference verification)

Capacity sufficiency (minimum 50,000+ tons annual)

Geographic logistics viability

STEP 3: Request Detailed Proposals

Pricing for primary application plus alternative specifications

Lead time commitments with expedited delivery options

Warranty coverage details and claims procedures

Quality assurance documentation (certifications, test reports)

Reference customer list for field performance verification

Technical specification compliance confirmation

STEP 4: Onsite Facility Assessment

Manufacturing equipment and capability assessment

Quality control procedures and documentation review

Production capacity observation and scheduling verification

Material handling and storage adequacy

Workforce training and expertise evaluation

Environmental compliance and safety standards adherence

STEP 5: Reference Customer Validation

Product quality consistency and durability

Delivery reliability and lead time adherence

Responsiveness to technical questions and problems

Warranty claim processing and resolution speed

Long-term partnership satisfaction and reliability

Customization capability for non-standard applications

STEP 6: Pilot Program Evaluation

Initial order at standard volumes (2-4 sets) enabling quality evaluation

Performance monitoring during first 2-3 replacement cycles

Quality feedback and continuous improvement documentation

Cost and delivery performance validation

Technical support responsiveness assessment

Customer satisfaction surveys

Effective casting jaw crusher jaw plate supplier selection requires balanced evaluation across quality, cost, delivery, support, and risk dimensions. No single supplier category dominates across all criteria—OEM suppliers provide maximum compatibility assurance at premium cost, quality aftermarket suppliers balance value and expertise, Chinese manufacturers dominate cost-competitive segments, and regional specialists prioritize rapid delivery and local support.

The optimal supplier strategy often involves portfolio approaches combining multiple vendors: primary OEM relationships for critical equipment requiring maximum compatibility assurance; quality aftermarket partnerships for cost-optimized routine replacements; Chinese manufacturers for high-volume or emergency surge capacity; and regional specialists for rapid-delivery emergency situations.

Procurement professionals achieving superior outcomes consistently follow systematic evaluation frameworks, prioritize quality verification over lowest-price selection, maintain competitive supplier diversity rather than dangerous single-source dependencies, conduct periodic performance reviews assessing continued suitability, and invest time in relationship management supporting long-term partnership stability.

The procurement decision ultimately reflects organizational risk tolerance, operational priorities, and strategic positioning within competitive markets. Suppliers delivering superior total value—accounting for quality consistency, on-time delivery, responsive support, and long-term reliability—generate operational advantages exceeding simple cost savings, justifying premium positioning and partnership investment.

For operations seeking comprehensive casting jaw crusher jaw plate solutions combining quality assurance, customization flexibility, responsive support, and competitive pricing, resources including detailed supplier comparisons, quality assessment tools, and industry-specific guidance are available at https://www.htwearparts.com/.