The global market for jaw crusher wear plates represents one of the fastest-growing segments within industrial crushing equipment, driven by sustained demand across mining, quarrying, construction demolition recycling, and cement manufacturing sectors. The jaw crusher wear parts market, valued at USD 1.2 billion in 2024, is projected to reach USD 2.5 billion by 2034, representing an impressive compound annual growth rate (CAGR) of 8.0%. This growth trajectory reflects fundamental shifts in global industrial activity—from intensifying mining operations for critical minerals supporting clean energy transitions, to surging construction waste recycling driven by sustainability mandates and circular economy initiatives.

Understanding the specific application requirements, wear characteristics, and material performance demands across different industries is critical for procurement professionals, equipment managers, and business development teams seeking to optimize equipment selection, forecast operational budgets, and identify strategic market opportunities. This comprehensive analysis examines how jaw crusher wear plates serve distinct industrial applications, explores the specific wear patterns and material requirements unique to each sector, and provides data-driven insights into market trends reshaping demand patterns through 2035.

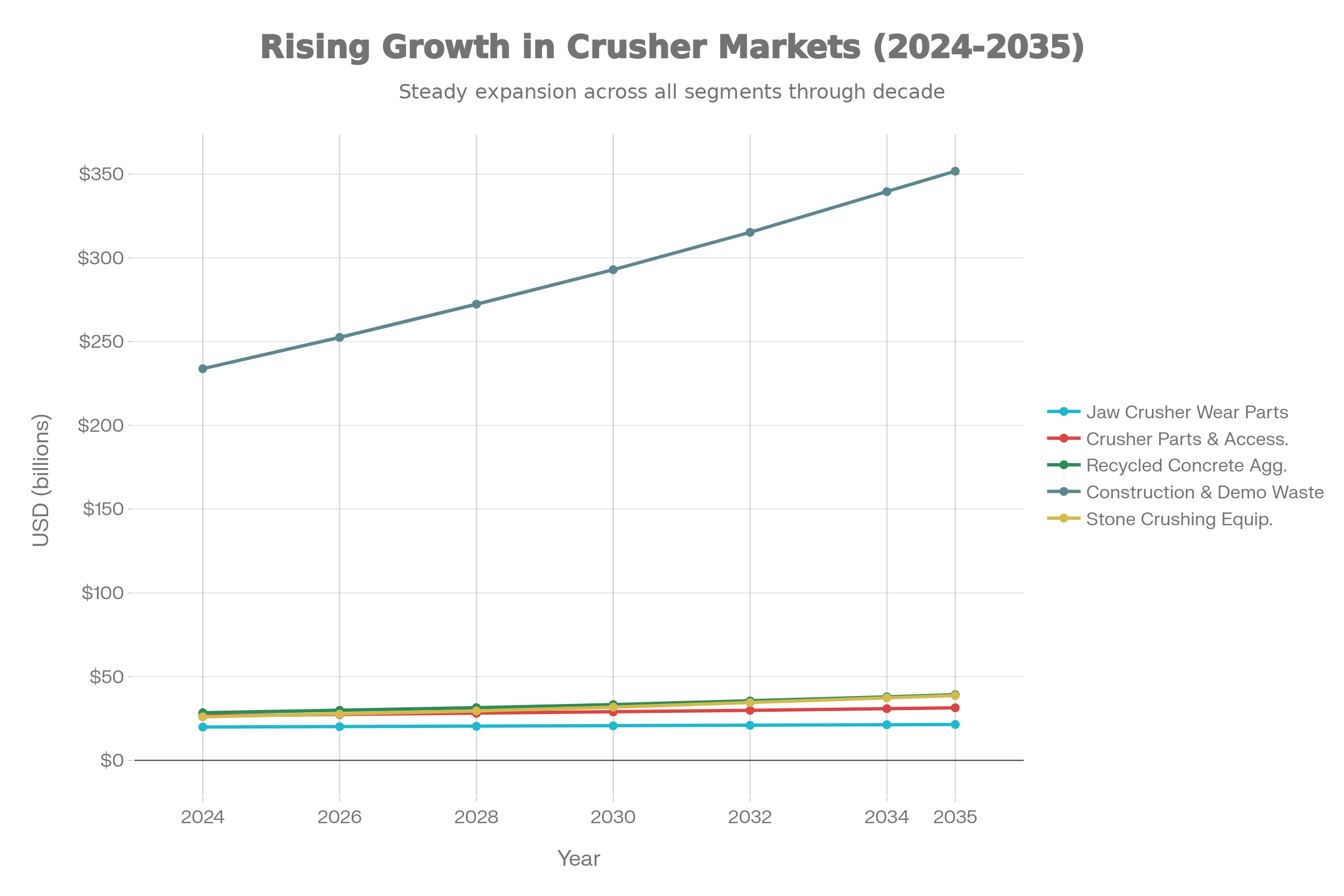

Global markets for crushing equipment and wear parts continue expanding at rates significantly outpacing broader industrial equipment growth. The overall crusher parts and accessories market is projected to reach USD 11.28 billion by 2035, representing a CAGR of 5.3%, while the stone crushing equipment market itself is projected to grow from USD 7.3 billion in 2025 to USD 18.6 billion by 2035 at a remarkable CAGR of 9.7%. Within this broader ecosystem, jaw crushers maintain dominant market positions—claiming 35.2% of the overall crusher market share in 2024—due to their widespread applicability, cost-efficiency, and superior performance for primary crushing operations across diverse materials.

The wear parts segment grows even faster than equipment sales themselves, reflecting two critical market realities. First, jaw crusher wear plates represent genuine consumable components requiring regular replacement—a typical granite quarry processes approximately 2,000 tons daily and experiences wear plate replacement cycles of 8-12 weeks using standard Mn18Cr2 materials. Second, as industrial operators increasingly prioritize operational uptime, equipment reliability, and total cost of ownership optimization, they invest in higher-quality wear plates that extend service intervals, reduce downtime, and ultimately deliver superior economic value despite premium initial costs.

This combination of hardware replacement cycles and performance-driven material upgrades creates a robust, recurring revenue stream for manufacturers and suppliers, explaining why wear parts markets grow faster than equipment sales themselves. The jaw crusher wear parts market CAGR of 8.0% significantly exceeds the broader jaw crushers market growth rate of 4.2%, demonstrating the powerful economics of the consumables replacement business model.

Mining represents the largest and most consistent application for jaw crusher wear plates globally, driving approximately 40-45% of total industry demand across all market segments. The sector encompasses precious metals mining, base metals extraction, and mineral processing operations ranging from small-scale artisanal operations to massive industrial complexes processing hundreds of thousands of tons annually.

Global mining investments reached USD 1 trillion in 2023, indicating robust sector recovery and expansion post-pandemic. This resurgence is further amplified by the global clean energy transition—the International Energy Agency's Global Critical Minerals Outlook 2024 projects that demand for minerals used in clean energy technologies will double by 2030 under current policies, with lithium demand alone expected to increase eightfold by 2040 under net-zero emissions scenarios. This unprecedented surge in mineral demand directly translates into accelerating jaw crusher requirements, as mining operators establish new operations, expand existing capacity, and upgrade aging equipment fleets.

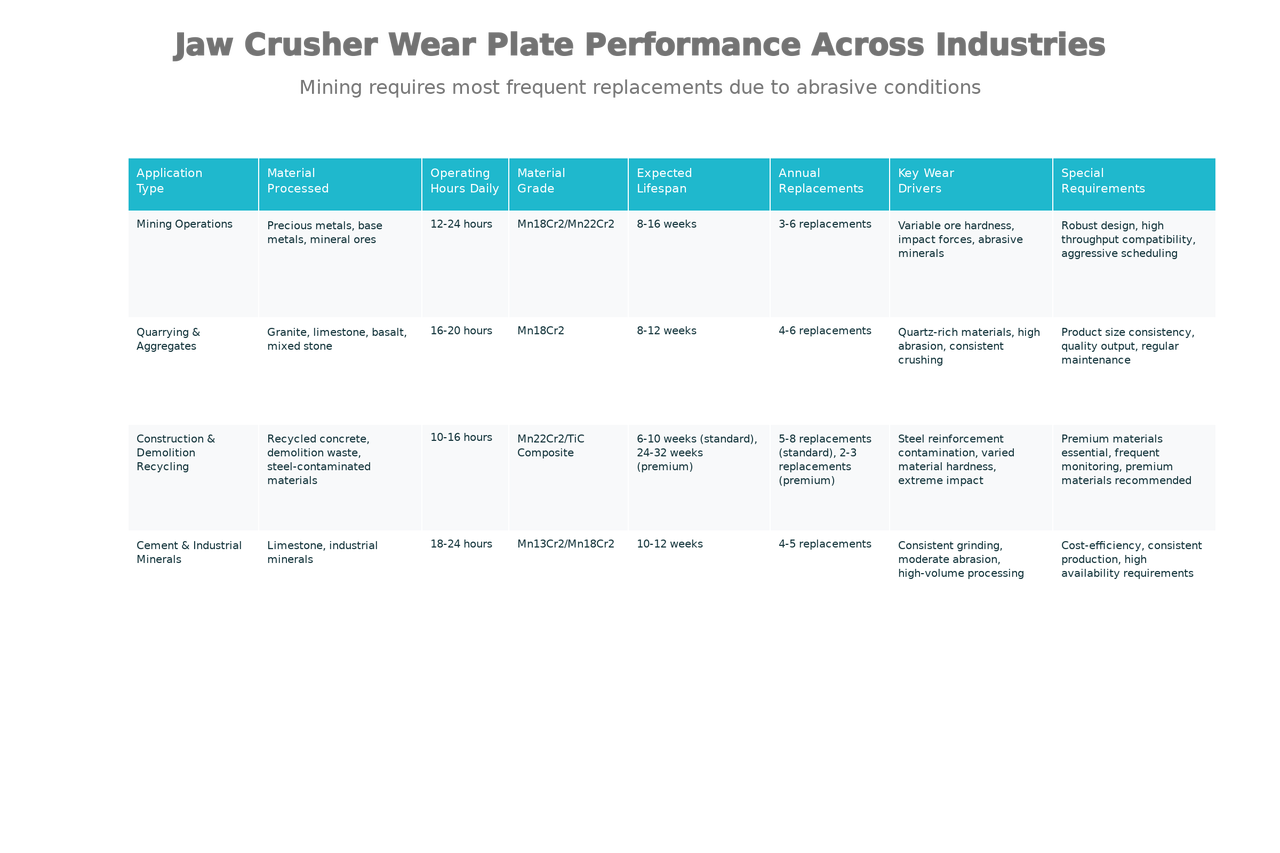

Mining jaw crusher operations present unique wear characteristics driven by the extreme variability in ore hardness, composition, and abrasiveness. Precious metals mining operations process ores ranging from soft, malleable materials to extremely hard, quartz-laden formations. Base metals mining (copper, zinc, nickel) frequently encounters highly abrasive ores containing iron oxides and silicates. The critical minerals rush—particularly lithium and cobalt extraction—introduces additional wear challenges as these ore bodies often contain exceptionally hard mineral phases requiring aggressive crushing forces.

Mining operations typically run crushers 12-24 hours daily, representing nearly continuous operational demands. This extended duty cycle accelerates wear plate degradation compared to intermittent applications, necessitating more frequent replacement cycles and higher-quality wear plate materials to maintain operational efficiency. The preferred material grades for standard mining applications are Mn18Cr2 (delivering 8-12 weeks of service life in moderately hard ores) and Mn22Cr2 (providing 12-16 weeks for extremely abrasive materials).

Premium materials including titanium carbide composites and tungsten carbide coatings see increasing adoption in mining applications—particularly operations processing quartz-rich ores or materials with high iron oxide content. These advanced materials extend operational lifespan to 24-32 weeks, reducing annual replacement frequency from 4-6 times to 2-3 times, thereby minimizing operational disruptions and reducing maintenance labor costs substantially.

The mining sector's robust growth trajectory ensures sustained demand for jaw crusher wear plates through the forecast period. The World Mining Congress reports that global mineral demand, particularly for clean energy minerals, will continue accelerating through 2035, with electric vehicle production requiring exponentially increasing quantities of lithium, cobalt, nickel, and rare earth elements. This creates a powerful tailwind for mining equipment suppliers, as mining operators expand existing operations and establish new mining projects globally.

Regional dynamics vary substantially—Asia-Pacific mining operations, particularly in China, Southeast Asia, and India, drive the highest volumes of jaw crusher adoption and wear plate consumption. African mining expansion, especially for critical minerals supporting battery and renewable energy technologies, represents one of the fastest-growing regional markets. Latin American mining operations, concentrated in precious metals and copper extraction, represent substantial stable demand.

Quarrying and natural aggregate production represent the single largest application for jaw crusher wear plates by volume, with global crushed stone production reaching 1.8 billion metric tons annually. This massive production volume reflects construction industry fundamentals—aggregate (sand, gravel, crushed stone) represents an essential input for concrete, asphalt, road foundations, and virtually all infrastructure construction. As global urbanization accelerates and infrastructure development continues across Asia, Africa, and Latin America, aggregate demand remains robust and predictable.

Aggregate quarrying operations process granite, limestone, basalt, and mixed stone materials, each presenting distinct wear characteristics. Granite and basalt, being quartz-rich and exceptionally hard, drive accelerated wear plate degradation—a typical granite quarry processing 2,000 tons daily with standard Mn18Cr2 wear plates experiences replacement cycles of 8-12 weeks. Limestone crushing, by contrast, presents lower abrasion stress, permitting replacement intervals of 5-6 months with standard materials, thereby reducing operational cost burdens substantially.

Quarrying operations prioritize product size consistency, particle shape, and output quality—factors directly influenced by wear plate condition. As plates wear, crushing efficiency declines, particle size distribution becomes inconsistent, and energy consumption increases. This quality degradation incentivizes more frequent replacement intervals compared to mining operations, as quarry operators prioritize maintaining consistent product specifications for downstream customers (ready-mix concrete plants, asphalt facilities, construction firms).

The preferred material for mainstream quarrying is Mn18Cr2—delivering optimal balance between cost and performance. Regional quarries processing 200-500 tons per hour typically utilize standard manganese steel grades, achieving 8-12 week service intervals. Larger operations processing 1,000+ tons per hour sometimes transition to Mn22Cr2 or advanced materials for extended wear life and reduced operational disruptions.

The International Labour Organization highlights that jaw crushers require approximately 20% less maintenance compared to alternative crushing technologies, directly driving quarrying operator preference for jaw-based primary crushing stages. This superior reliability and lower maintenance burden strengthen quarrying sector demand for jaw crusher wear plates, as operators recognize that maintaining optimal jaw crusher performance through quality wear plate replacement delivers superior total cost of ownership compared to alternative crushing technologies.

Construction and demolition (C&D) waste recycling represents the fastest-growing application segment for jaw crusher wear plates, driven by powerful regulatory mandates, economic incentives, and sustainability commitments across developed nations. The global construction and demolition waste management market, valued at USD 215.1 billion in 2024, is projected to reach USD 274.2 billion by 2030, representing a CAGR of 4.1%. More specifically, the recycled concrete aggregates market alone is projected to grow from USD 9.75 billion in 2024 to USD 18.74 billion by 2034 at a robust CAGR of 6.75%.

This remarkable growth reflects fundamental shifts in construction industry practices—governments increasingly mandate waste diversion targets, landfill costs escalate, environmental regulations tighten, and customer demand for sustainable building practices intensifies. The concrete recycling equipment segment, which relies heavily on jaw crushers for primary crushing operations, generated USD 0.59 billion in revenue in 2024 with a projected CAGR of 6.5%.

Construction and demolition recycling presents the most extreme wear challenges for jaw crusher wear plates. Unlike mining or quarrying applications processing relatively homogeneous materials, demolition waste contains concrete mixed with steel reinforcement, metals, wood, gypsum, and diverse mineral components. Steel-reinforced concrete (rebar) creates particular challenges—as jaw plates compress mixed debris containing steel elements, they experience impact forces that exceed normal crushing stresses, accelerating plate degradation by 50% or more compared to comparable operations on unmixed stone.

This harsh operating environment drives strong demand for premium wear plate materials. Standard Mn13Cr2 or Mn18Cr2 plates deliver only 6-10 weeks of service life in recycled concrete applications—requiring replacement 5-8 times annually. Operators processing high volumes of recycled demolition concrete increasingly transition to Mn22Cr2 or advanced composite materials (titanium carbide inserts, high-chromium cast iron) that deliver 24-32 weeks of service life, reducing annual replacement frequency to 2-3 times and justifying premium material costs through substantially reduced downtime and maintenance labor.

The concrete recycling equipment segment dominated the overall concrete recycling market in 2024 with USD 0.59 billion in revenue, reflecting the capital intensity and wear component consumption of crushing operations. Large-scale recycling operations in North America, Europe, and increasingly in Asia-Pacific demonstrate robust adoption of advanced crushing technologies including mobile crushers equipped with integrated screens and sorting systems.

North America leads the recycled concrete aggregates market, accounting for substantial volume in 2024 due to established construction waste management infrastructure, stringent environmental regulations, and widespread adoption of sustainable construction practices. The U.S. market alone is estimated at USD 58.6 billion in the broader construction and demolition waste management sector, with concrete recycling representing a significant portion.

The Asia-Pacific region emerges as the fastest-growing market for demolition waste recycling and recycled concrete processing, driven by rapid urbanization, aging building stock requiring replacement, and increasing government environmental mandates. China, with massive urban development and infrastructure modernization programs, drives substantial jaw crusher wear plate demand within this region.

Cement manufacturing and industrial minerals processing represent significant applications for jaw crushers, driven by the massive global demand for cement and industrial mineral products. The global cement industry alone consumes approximately 4.1 billion tons of cement annually, with limestone crushing serving as the foundational raw material processing step. These high-volume, continuous-operation facilities demand robust, reliable crushing equipment and frequent wear component replacement.

Cement manufacturing typically involves limestone crushing for primary cement production, with crushing operations running 18-24 hours daily to meet continuous production demands. These extended operating hours accelerate wear plate degradation compared to intermittent mining or quarrying applications. However, limestone—being a relatively soft, moderately abrasive material—generates less severe wear stresses compared to granite or demolition-contaminated recycled concrete.

The preferred material for cement industry applications is typically Mn13Cr2 or Mn18Cr2, delivering 10-12 weeks of service intervals with replacement frequency of 4-5 times annually. The emphasis in cement operations focuses on maintaining consistent production availability rather than maximizing material lifespan, as the cost of production downtime substantially exceeds incremental wear plate material costs.

Cement industry demand for jaw crusher wear plates remains remarkably stable and predictable, reflecting the essential nature of cement in global construction and the massive, continuous capital investment in cement manufacturing infrastructure across emerging economies. While growth rates are more modest than demolition recycling or clean energy-driven mining, the absolute volume of jaw crusher wear plate consumption in cement applications remains substantial.

Mobile Crusher Adoption and Equipment Modernization

The mobile jaw crusher market is experiencing accelerating adoption, projected to grow at a CAGR of 4-6% through 2035. These portable crushing units enable on-site processing of construction and demolition waste, reducing transportation costs and environmental impact while improving processing flexibility. Mobile crushers create incremental demand for wear plates, as equipment rental companies and small-to-medium contractors expand portable crushing capacity to serve distributed project sites. This trend particularly benefits suppliers of smaller, modular wear plate designs and quick-change components.

Sustainability and Circular Economy Initiatives

Global sustainability mandates, carbon reduction targets, and circular economy frameworks drive accelerating adoption of waste recycling and recovered material processing. The European Union's circular economy action plan, combined with tightening environmental regulations in Asia and North America, creates powerful incentives for construction waste recycling and recovered material reuse. These policy frameworks translate directly into increased jaw crusher utilization, greater wear plate consumption, and premium pricing for materials enabling efficient recycling operations.

Technology Integration and Predictive Maintenance

Modern crushing equipment increasingly incorporates digital monitoring systems, IoT sensors, and predictive maintenance algorithms enabling operators to optimize wear plate replacement schedules based on actual wear progression rather than predetermined intervals. This technological advancement drives demand for wear plates with embedded sensors and enhanced data logging capabilities. It also creates opportunities for suppliers offering integrated monitoring systems and maintenance optimization services alongside physical wear components.

Critical Minerals Rush and Clean Energy Mining

The global transition to clean energy and electric vehicles drives unprecedented demand for lithium, cobalt, nickel, copper, and rare earth minerals. Mining operations establishing new capacity for these critical minerals typically prioritize operational efficiency and equipment reliability, often justifying premium wear plate investments. The International Energy Agency projects that mining capacity for clean energy minerals must triple by 2040 to meet decarbonization targets, creating a multi-decade growth opportunity for mining equipment suppliers and wear component manufacturers.

Regional Infrastructure Investment and Urbanization

Massive infrastructure investments in Asia, Africa, and Latin America drive sustained aggregate demand and crushing equipment utilization. China's Belt and Road Initiative, combined with large-scale infrastructure projects across Southeast Asia, African nations, and Latin America, ensures robust demand for primary crushing capacity. These developing economies increasingly prioritize domestic crushing operations over imported aggregates, expanding the addressable market for jaw crusher manufacturers and wear component suppliers.

Understanding application-specific wear characteristics enables more accurate budgeting and scheduling of replacement cycles. Operations processing recycled demolition concrete should allocate substantially higher wear plate budgets and plan for more frequent replacement intervals compared to limestone quarrying operations. Premium material investments, while commanding higher initial costs, frequently deliver 30-50% total cost of ownership advantages through reduced downtime and maintenance labor in demanding applications.

Market growth remains robust across all application segments through 2035, with recycled concrete processing and critical minerals mining representing the fastest-growing opportunities. Regional variations suggest distinct market entry strategies—Asia-Pacific operations increasingly demand rapid equipment deployment and extended supplier support infrastructure, while North American and European customers prioritize sustainability credentials and advanced material options. Strategic supplier positioning should emphasize industry specialization, regional infrastructure, and integrated support services rather than competing solely on commodity pricing.

The jaw crusher wear plates market offers substantial opportunities to optimize supplier relationships, material costs, and operational reliability through strategic vendor consolidation and long-term partnership development. Evaluating suppliers on total cost of ownership metrics—accounting for material lifespan, installation labor, operational downtime, and maintenance requirements—identifies superior long-term value compared to simple unit price comparison. Premium suppliers offering comprehensive technical support, rapid sample development, and integrated monitoring systems frequently justify investment through measurable operational improvements.

The jaw crusher wear plates market remains positioned for sustained, robust growth through 2035, driven by fundamental industrial trends including mining expansion, construction aggregate demand, demolition waste recycling acceleration, and cement production continuity. The market's 8.0% CAGR significantly outpaces broader economic growth rates, reflecting the consumables replacement business model dynamics and increasing operational focus on equipment reliability and total cost of ownership optimization.

Understanding application-specific requirements—from mining's variable ore hardness challenges, to quarrying's emphasis on product quality consistency, to demolition recycling's extreme wear pressures—enables procurement professionals and business development teams to optimize supplier selection, material choices, and operational budgeting. Regional variations in application mix, regulatory environments, and infrastructure investment patterns create distinct market opportunities requiring tailored supplier positioning and product offering strategies.